Protect Your Care Business with Trusted Insurance

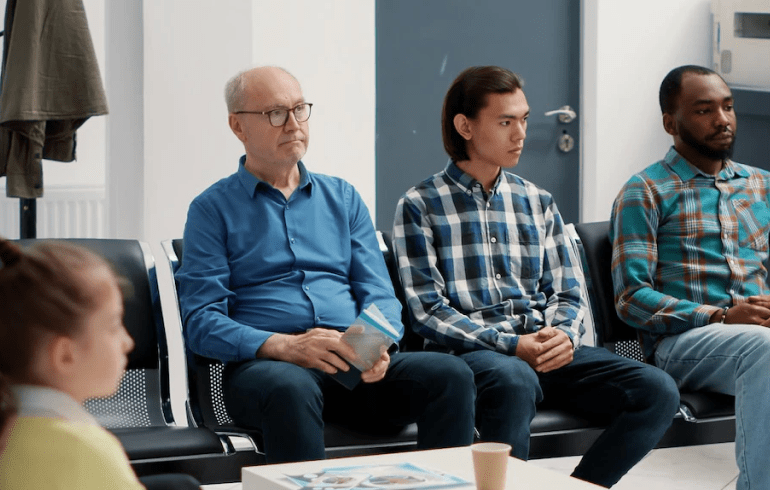

Tailored cover for care homes, agencies, new providers, and solo carers

Affordable, tailored insurance for care providers. PolicyBase connects you with FCA-regulated partners offering public liability, employer’s liability, and professional indemnity cover.

GET A QUOTE

Business with Trusted Insurance

Types of Insurance We Support

Public Liability Insurance

Protects your care business if someone is injured or their property is damaged while under your care. Essential for safety and peace of mind.

Employer’s Liability Insurance

A legal requirement if you employ staff. Covers claims from employees who are injured or become unwell because of their work.

Professional Indemnity Insurance

Protects you against mistakes, errors, or claims of negligence when delivering care services. Gives confidence to inspectors and clients alike.

Additional Cover Options

Specialist policies available depending on your care setting — tailored extras to keep your business fully protected.

Policy Base Insurance Services

Why Insurance Matters in Care

How PolicyBase Helps

Pусский

Pусский